In 2021, the operator allocated expenses for the 'maintenance of capital items', to the residents 'Capital Works Fund' (CWF) to the value of $186,147.07. This occurred without the knowledge or consent of the residents.

How could this happen

The operator of this retirement village is required under Section 98 (1)(a) and (b) of the Retirement Villages Act to notify residents if they intend to use any part of the 'capital works fund' (CWF) for capital maintenance. This notification must include estimated costs and/or quotes obtained for the repairs, and this information should be part of the proposed annual budget presented to residents.

The operator did not inform residents about planned maintenance work on capital items in the proposed budgets for 2021 to 2023. Furthermore, there was no reference to the costs associated with such maintenance work in the operator's end-of-year audited financial reports for those years. Consequently, expenses were allocated to the residents' capital works fund without their knowledge.

In addition to the requirements under Section 98 of the Act, the amended Regulations 2017, also insist that the operator of a retirement village must include in the proposed annual budget a report relating to capital maintenance for major items of capital, including shared major items of capital, for a relevant 3-year period that is extracted from the information contained in the asset management plan current for that period (3-year report). No such reports were submitted to the residents.

Fair Trading clarification

Residents in retirement villages can and often do question the cost of capital maintenance included in their budget. Retirement village operators are required to include capital maintenance costs in the annual budget, and residents have the right to review, consent, and/or object to this expenditure.

Operators non-compliance with the Act

The operator's non-compliance with the Act, for three consecutive years, has prevented residents from reviewing, consenting to, or objecting to this expenditure, which has been allocated to the capital works fund.

The budget process in a retirement village is designed to promote transparency, informing residents how the operator will spend their recurrent charges in the coming year. The lack of transparency regarding the capital works fund for the 2021-2023 financial years should be noted by all residents.

Unable to reconcile the Capital Works Fund

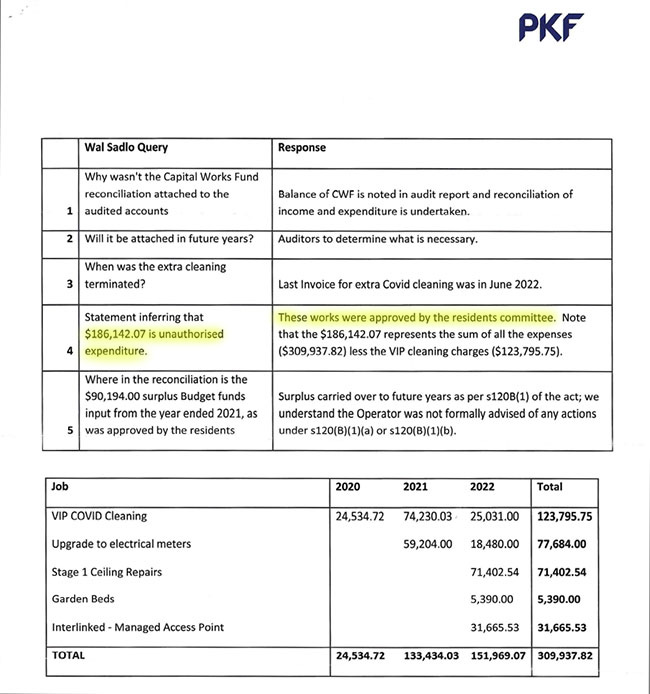

The difficulty in reconciling the CWF balance presented by the operator led to requests for additional information from both management and the operator's accountant, PKF.

Upon reviewing this information, it was found that significant expenses had been allocated to the capital works fund. However, residents were not informed through the budgetary process or via the operator's end-of-financial-year audited reports.

The correspondence below between Ms. Stewart Smith (Village Manager) and Andrew Porvaznik (Operator's Accountant) provides clarification on why the capital works fund could not be reconciled (highlighted in yellow - graphic below).

Editor's Note 1: While numerous 'Ministerial Orders' were in place at this time because of the COVID-19 pandemic, Fair Trading has confirmed that no relief was provided for retirement village operators to access the capital works fund without the consent of residents, which is a requirement under the Retirement Villages Act.

The above correspondence between the village manager and the operator's accountant (graphic above) indicates that approval for these huge expenses allocated to the CWF was made by a member or members of the resident committee in office at the time. The above correspondence falls short of identifying these committee members.

Editor's Note 2:

A member or members of a residents committee do not possess the authority to provide approvals for matters that require the consent of residents. Approval for the allocation of expenses to the capital works fund requires the consent of residents.

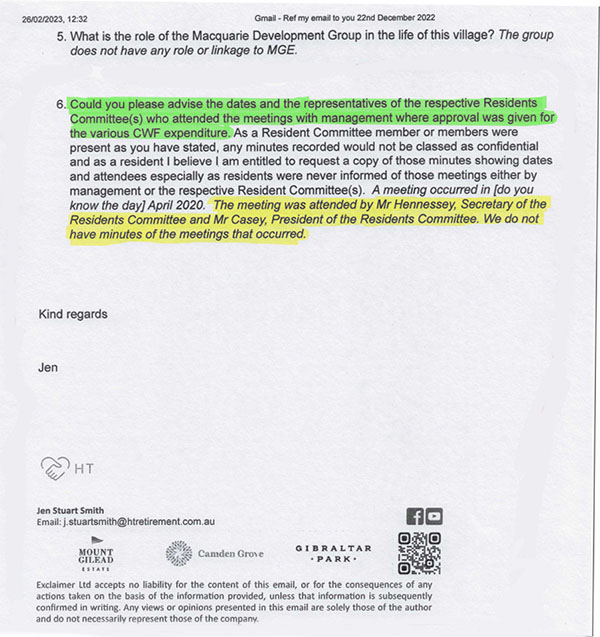

Mr. Sadlo, a village resident, had sent numerous pieces of correspondence to management, seeking explanations and details of who approved the allocation of the said expenses mentioned above to the 'Capital Works Fund'.

Ms. Jennifer Stuart Smith, the Village Manager at the time, in answer to questions posed by Mr. Sadlo, provided the following information: -

According to Ms. Stewart Smith, Mr. Casey and Mr. Hennessey were the two resident committee members who provided the approvals to allocate $186,147.07 to the capital works fund on behalf of the residents of the village, despite not having the authority to do so.

Since the committee members have been identified as acting outside their authority and contrary to legislation meant to protect residents and their funds, there are further issues that need to be addressed.

As Mr. Casey was the President of the Residents Committee at the time and Mr. Hennessey the Secretary, residents should have been informed about the large expenses allocated to the capital works fund during their tenure. After approving $186,147 worth of expenses, which allows the operator to access and transfer that amount from the capital works fund to the operator's working accounts, it would be expected that the President and Secretary of the Residents Committee would inform the residents about the approval of such a significant sum of money to be deducted from their capital works fund.

Unfortunately, that's not the case. A check of all communications from the Residents Committee to the residents confirmed that no advice was sent out to the residents, by the Casey/Hennessey committee, regarding the committee's approval of the huge expenses allocated to the capital works fund.

It is concerning that residents were not informed of these approvals. It is possible that the committee members involved were aware they lacked the authorization to provide such approvals. Regardless, it is reasonable to expect that the President and Secretary of the committee at the time would have documented these meetings, ensuring that they could report back to the other committee members about the discussions held with Mr. Singer and Mr. Porvaznik.

However, there are no committee minutes indicating that any meeting took place with Mr. Singer and Mr. Porvaznik. Furthermore, Ms. Stewart Smith (Village Manager) has stated in her correspondence to Mr. Sadlo that "we do not have minutes of the meetings that occurred". This lack of documentation suggests that the meetings were conducted without proper record-keeping, and the attendees did not relay information from these meetings to the village residents.

Why didn't the Operator's preferred auditor PKF, identify this issue?

With these huge expenses allocated to the residents' capital works fund, yet not referred to at all in the end-of-financial-year reports by the operator, why did the auditor not flag these expenses as an issue of concern and advise the residents accordingly?

Operators responsibility

Under the Retirement Villages Act, it is a requirement that the operator's audited end-of-financial-year reports/annual accounts detail the income and expenditure of the village during the financial year, including income and expenditure of the capital works fund.

The operator did not include any expenditure of the capital works fund in their end-of-financial-year reports/annual audited accounts for the specified years, despite allocating significant expenses to the CWF during that same period, thus failing to comply with the Act.

The omission of expenses allocated to the CWF for three consecutive years in their EOFY audited reports contributed to challenges faced by the resident's committees and finance subcommittees in office at those times. This issue made it difficult to reconcile the CWF and recognize that the surplus to budget amount of $90,000 in 2021 had not been appropriately carried forward or handled according to the residents' preferences.

Relevant budget data in support of the above information

The annual proposed budgets and financial reports for the years mentioned above are available for residents to view, below.

- Proposed budget & Financial Reports for the 2019-2020 financial year, click here.

- Proposed budget & Financial Reports for the 2020-2021 financial year, click here.

- Proposed budget & Financial Reports for the 2021-2022 financial year, click here.

Residents may note, that the operator has failed to include any expenditure allocated to the resident's capital works fund, in any of the above end-of-financial years audited reports.