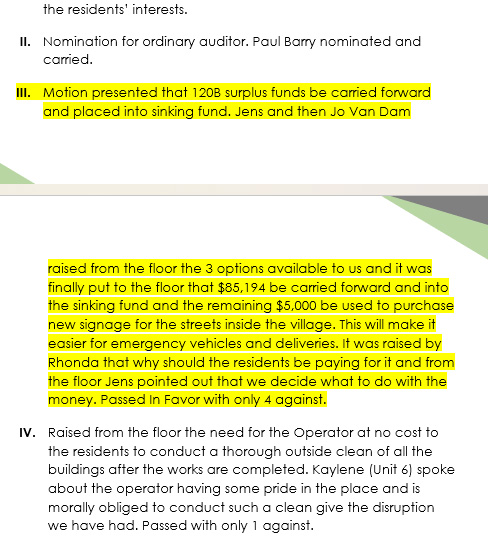

At the conclusion of the 2020-21 financial year, the Operator reported a surplus to budget of $90,194. This was seen as a good result for the residents, who, at the 2021 AGM, voted to allocate $5,000 of the 'surplus' to the upgrade of street signage within the village, and the remainder, $85,194 to be placed into the 'Capital Works Fund' (CWF).

Editor's Note: Minutes of the 2021 residents AGM were supplied to Management on the 17 December 2021. Those minutes clearly indicated how the residents voted to distribute the 'surplus to budget' amount of $90,194. An extract of those minutes is shown below, 'Graphic 1'.

Residents have a reasonable expectation that Management would process the 2020-21 'surplus to budget' amount of $90,194 in accordance with their wishes. The resident's decision, which required their consent, by way of a motion put and carried by a majority vote, is clearly indicated in the above minutes.

Management have indicated that they were not provided with formal directions as to the processing of the 'surplus to budget' amount of $90,194, by the residents committee. Mr. Van Dam also made mention at the last (2023) AGM that the committee had not formally advised the Operator how to process the surplus to budget amount of $90,194, referring to the Retirement Villages Act 1999, Schedule 1 Consent of Residents, Part 2, Consent Generally, No. 4 Result of Vote. (quoted below)

(1) The operator of a retirement village must accept as the residents’ decision in relation to a measure or action that requires their consent the decision that is reported to the operator by—(a) an officer of the Residents Committee, or ......

It is the 2021-23 Residents Committee's interpretation of this section of the Retirement Villages Act, that by providing the Operator/Management with a copy of the 2021 AGM minutes, is reporting the decision made by the residents, (by way of a motion put and decided by majority vote), directly to the Operator/Management. As the Secretary of the Residents Committee (obviously an officer of the Residents Committee) prepared the minutes, then forwarded (reported) such minutes to the Operator/Management, it would appear the committee has complied with the above section of the RV Act. Nowhere in the above section of the RV Act does it mention that a 'formal notification' is required, simply that the decision is reported to the Operator.

If Management were in any doubt, as how to treat the 'surplus to budget', after receiving the said minutes, a phone call or email from Management to the Residents Committee seeking clarification, would certainly have solved any problems. No phone call or email communication was received from management regarding the surplus to budget amount of $90,194.

Management has now indicated that they have carried the 2020-21 'surplus to budget' over to the next financial year, which is the normal or default option when dealing with a surplus to the budget for a given financial year. That's providing the residents have not voted by a special resolution to distribute the surplus in another manner.

Note: When the Operator of a retirement village carries a surplus to budget forward to the next financial year, that surplus amount must be shown in the proposed budget for that next financial year. Thus, showing residents that the surplus has been carried forward correctly.

An examination of the 2021-22 proposed budget shows no such 'surplus to budget' amount has been carried forward from the previous financial year. To view the 2021-22 proposed budget, click here...

An examination of the 2022-23 proposed budget shows no such 'surplus to budget' amount has been carried forward from the previous financial year. To view the 2022-23 proposed budget, click here...

An examination of the 2023-24 proposed budget shows no such 'surplus to budget' amount has been carried forward from the previous financial year. To view the 2023-24 proposed budget, click here...

If management has carried the surplus to budget forward as indicated in their correspondence to residents, then why is there no reference to the surplus to budget amount of $90,194 in the 2021-22, the 2022-23 or the 2023-24 proposed budgets?

There is not one financial report, including the 'Income and Expenditure Statements' supplied to residents, that shows how management has processed the 2020-21 surplus to budget amount of $90,194. Even more concerning is the fact that the Auditor (PKF) has not picked on or reported on this issue for the last 2-3 years.

However, the Finance Sub-Committee and the 2022-23 Residents Committee have been unable to find any reference in the following years (2021-22 or the 2022-23) accounts supplied by Management, where this occurred.

The Retirement Villages Residents Association (RVRA) has indicated that any surplus carried forward to the next financial year, must be shown in the proposed budget for that next financial year. If, as management has suggested, the surplus to budget has been carried forward to the next financial year, in compliance with the RV Act, then why is there no reference to the surplus to budget amount in the 2021-22, the 2022-23 or the 2023-24 proposed budgets?

Issue of concern

Another concerning issue is the lack of financial reporting, involving large sums of money, going out of the 'Capital Works Fund'.

It is indeed puzzling that the previous Auditor (PKF) has not identified the 'surplus to budget issue' over the last couple of years, nor reported any movements of large sums of money out of the capital works fund, in his annual reports. One would think the capital works fund would be one of the first accounts to be scrutinized, with a suitable report issued to the residents, as it is the residents who pay the Auditors' fees.

Where is the 2021 surplus to budget amount $90,194 sitting now?

Management has not indicated the account that the $90,194 been carried forward to, and for the want of a better term, parked, in readiness to distribute, as indicated and voted by the village residents. So, where is it?

Note: The residents have the right to distribute the entire surplus amount back to themselves. This could have been done at the 2021 AGM, with a motion put by a resident and then carried by a majority vote. Of course, this didn't happen, the residents chose a more traditional and safe approach, by putting the bulk of the surplus into the capital works fund, to cover any large capital maintenance expenses which may occur in the future.

Such money should have been placed into the capital works fund, where it would accrue interest for the benefit of the residents of the village. It should not be brought forward and placed in the Operators working accounts, for the benefit of the Operator. Such a surplus cannot be brought forward and offset against a deficit for the coming financial year.

Excessive time taken to identify '2021 surplus to budget' not processed as per residents wishes

Why has the Residents Committee and the Finance Sub-Committee taken so long to realize that the '2021 surplus to budget', has not been placed into the CWF as forwarded/reported to Management on the 17 December 2021, by the then Secretary of the Residents Committee?

It was while examining and attempting to reconcile the CWF that an even greater issue became apparent, involving large expenses allocated against our capital works fund, with no supporting approval or authorization from the resident body. A check of the Residents Committee correspondence from 2020 onward, showed no meetings were called, to seek approval via a special resolution to allocate large expenses against our CWF. A further check of proposed budgets supplied by Management, from 2020 onward, showed no proposals or plans for capital maintenance spending, up until the current (2023-24) budget.

So where did Management get the authority or approval to allocate large expenses against our Capital Works Fund for the last couple of years?

The lack of details provided by the Operator for the allocation of large expenses against the CWF, with little or no explanation to the residents of the village, over several years, has allowed the process to continue unchecked. Coupled with the fact that the Auditor has not reported any movements of large sums out of the CWF, over many years, has also allowed this process to continue.

Insufficient information supplied by Operator

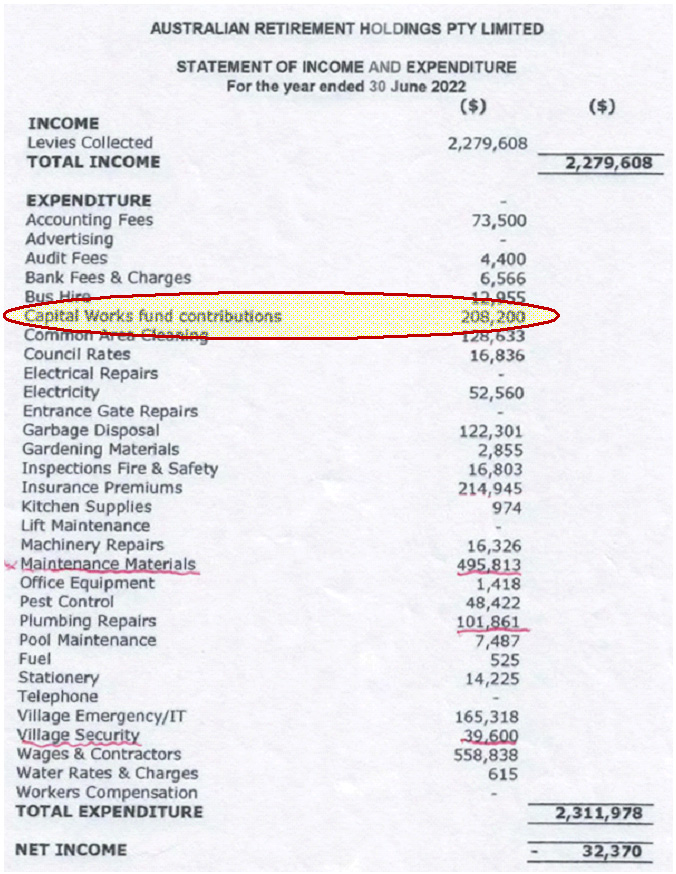

- Historically, Management has only supplied the Capital Works Fund contributions via their 'Income and Expenditure Statement' issued at the end of each financial year. (Example shown below: Graphic 2)

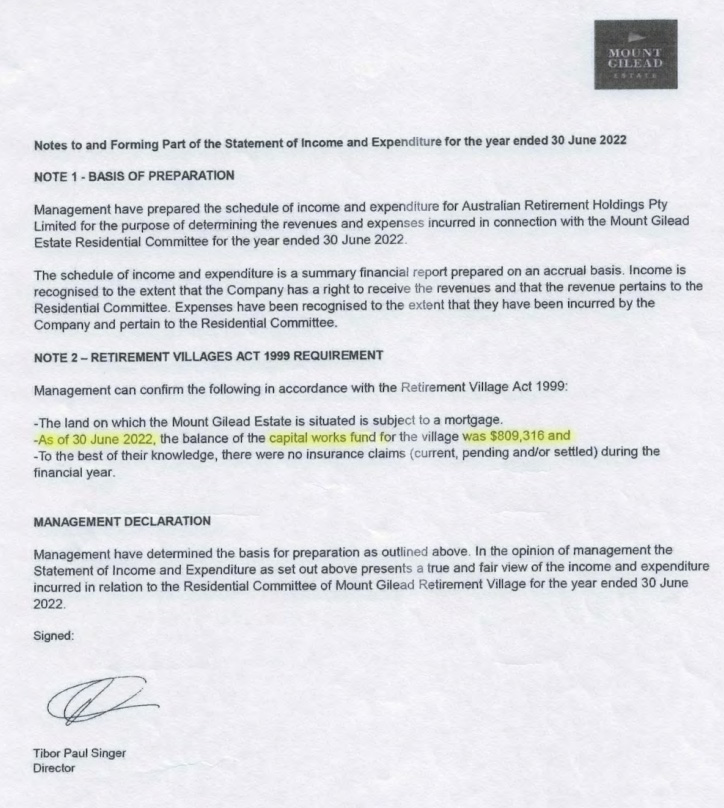

- Next, the Operator supplies his end of year notes as part of his end of financial year preparatory documentation, shown below. This indicated the balance of the capital works fund, in this case, at the end of June 2022 - $809,316.

- The two pieces of information shown in the graphics above are the only two financial documents supplied each financial year by Management, to show residents the movements in their Capital Works Fund. Note: These documents show no expenses that have been allocated against the CWF.

- Management do not supply transaction reports, bank statements or reconciliations of the CWF, which could assist the Residents Committee, the Finance Sub-Committee, and residents to determine if items/transactions such as the 2021 surplus to budget, has been processed and accounted for correctly, or in this case, processed in the manner that the residents decided.

- As a result, the Residents Committee and Finance Sub-Committee have to work backwards to check that the CWF figures are accurate as reported by the Operator.

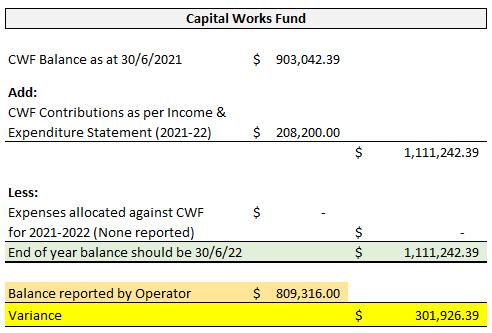

Both committees then go back and pick up the end of year balance for 2020-21 CWF, add the CWF contributions for the 2021-22 financial year (shown above Graphic 2), then deduct any expenses allocated against our CWF for that year, and we should get the same balance as reported by the Operator at the end of the 2021-22 financial year, stated above - $809,316.

A check of the correspondence of Management and the Residents Committee's in power at the time shows no correspondence has been distributed to residents advising any meetings, to seek approval to allocate expenses against our capital works fund. As far as we were aware, no expenses had been allocated to our capital works fund. The Mundt Residents Committee has been in office for the past two years and has not called a meeting to seek approval for the Operator to allocate large expenses against our capital works fund.

This makes our reconciliation easier, as there should be no expenses going out of the CWF. See small reconciliation set out below: -

With a variance of over $300,000, one can understand why the residents committee and the finance sub-committee were seeking answers as to why there was such a huge discrepancy.

Requests to management for copies of the CWF bank statements were originally denied, only later did they supply some bank statements, however not for the specific time frame requested.

It became obvious that large expenses had been allocated against our capital works fund, but both committees were puzzled as to how the Operator had accessed the CWF without residents' approval, as no indication or approval had been sought or given via the proposed budgets for those years.

Our ever-vigilant resident, Mr. Walter Sadlo was right onto Managment about this issue, and it was he who originally raised the issue to Ms. Jennifer Stuart Smith at the last management meeting.

Using end of year balances for the Capital Works Fund supplied by Management, it became evident to Mr. Sadlo that there must have been large expenses allocated against the capital works fund, which would be a logical explanation for such discrepancies in the balances put forward by management.

Mr. Sadlo had further communications with Ms. Stuart Smith, regarding this issue. Ms. Stuart Smith informed Mr. Sadlo that such expenses allocated against the capital works fund had all been approved.

Mr. Sadlo, like any other diligent resident, checked all communications from management and the residents' committees in power at the time, and could find no communications from either, advising that large expenses had been approved and allocated against the residents' capital works fund.

This prompted Mr. Sadlo to again communicate with Ms. Stuart Smith, seeking answers to specific issues, such as, who approved such large expenses allocated against our capital works fund for the last couple of years?

In reply to Mr. Sadlo's questions, Ms. Jennifer Stuart Smith supplied the following information (letter). Ms. Stuart Smith freely provided this letter to Mr. Sadlo, in answer to questions sought about the village finances. No restrictions, either verbally or in written form, were advised by Ms. Stuart Smith as to the supplied letters use. Mr. Sadlo provided this letter to the Residents Committee at the time, for the information and benefit of all residents and other interested parties.

From the attached letter (shown below) on PKF letterhead, it would appear that Jennifer Stuart Smith had sought information from PKF(NS) Tax P/L in answer to Mr. Sadlo's questions regarding the capital works fund, and this letter is in response to the information sought.

For then residents information, a copy of the 2020

Management is now suggesting that they have not received 'any direction' from the Residents Committee at the time, regarding the transfer of the surplus to the CWF.

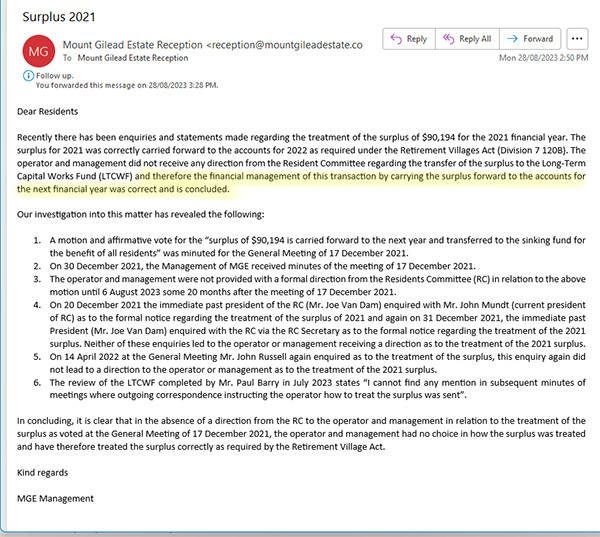

Set out below is a response by Management (HTR) in relation to the Residents Committee's enquiries and the Finance Sub-Committee enquiries as to why the $90,194 had not found its way into the Capital Works Fund, in compliance with the residents wishes, as voted at the 2021 AGM.

Any surplus to the budget should be carried forward to the next financial year. When the Operator declares a surplus to the budget, that surplus money is no longer the Operator's money.

The surplus amount should be carried forward and parked in an account, until the residents decide how they would like to treat such a surplus. For example, if residents so decided by majority vote, the surplus to budget can be distributed back to the residents of the village.

At the 2021 AGM, the decision made by the residents, by way of 'Motion put' and 'carried by majority vote', was to allocate $5,000 to the upgrade of street signage and the remainder to be placed into the 'Capital Works Fund (Sinking Fund).

This information was provided to Management in December 2021, by supplying a copy of the AGM minutes to Management clearly showing the residents' wishes on how the surplus to budget should be treated. This information was supplied by the Secretary of the Residents Committee at the time.

With this information forwarded to Management, there should be little or no doubt as to how the residents have decided to deal with the 'surplus to budget'.

The Retirement Villages Act states: -

(1) Any surplus in the annual accounts of a retirement village is to be carried forward to the accounts for the next financial year unless -(a) the residents of the village consent to a proposal for the expenditure of the whole or any part of the surplus, or(b) the residents of the village consent to a proposal that the operator distribute the whole or any part of the surplus (the distributable amount) to the existing residents of the village as follows—(i) by allocating a per-premises amount to each existing residential premises in the village,(ii) by distributing the per-premises amount allocated to each existing residential premises equally between the existing residents of the premises.

Management is suggesting they require more formal notification of how to treat the said 'surplus'. That such formal notification should have come from the Residents Commitee at the time.

Where we sit at the moment -

- Management acknowledges receipt of the AGM minutes, supplied (reported) to management by the secretary of the residents committee, on the 17 December 2021.

- Those minutes clearly spell out the residents' wishes, as to how the 'surplus to budget' should be treated.

- Both the Residents Committee and the Finance Sub Committee have had numerous verbal and written communications with Management on this issue.

- Management suggested more formal notification of how to treat the surplus was required from the residents committee, quoting, and appearing to be reliant on Schedule 1 Consent of Residents, Part 2 Consent Generally, paragraph (4) Result of vote. (Shown below)

Retirement Village Act 1999- Schedule 1 (copied from the RV Act)

Part 2 Consent Generally

Section 4 Result of vote

(1) The operator of a retirement village must accept as the residents’ decision in relation to a measure or action that requires their consent the decision that is reported to the operator by—(a) an officer of the Residents Committee, or(b) if there is no Residents Committee established for the village, a resident elected by the means referred to in clause 3 (1) of this Schedule as the representative of the residents of the village in relation to the measure or action concerned.

(2) Regulations may be made for or with respect to the election of a representative of residents for the purposes of subclause (1).

The Retirement Villages Act (shown above) does not indicate that a formal direction is required, simply that the decision made by the residents is reported to the Operator by a member of the Residents Committee. As the minutes of the AGM were reported to the Operator/Management (copy supplied) by a member of the Residents' Committee (Secretary), it would certainly appear that the Residents Committee have complied with this section of the RV Act.

As acknowledged by Ms. J.S. Smith in her correspondence to residents (shown above) dated 28 August 2023, Management received minutes of the 2021 AGM in December 2021, which clearly shows how the residents have voted to treat the 2020-21 surplus to budget.

Additionally, there are numerous rules set out under the Retirement Villages Act and its Regs, that govern the conduct of Operators of Retirement Villages.

Schedule 3A Rules of Conduct for Operators of Retirement Villages (Retirement Villages Regulation 2017)

Part 2 Standards of Conduct

Sect (6) (1) Operators must have regard to the best interests of all residents

Q1. Is the Operator/Management suggesting that carrying the 'surplus to budget' ($90,194) forward and retaining it in the Operators working accounts for 2 years, as opposed to depositing it in the Capital Works Funds, (where it would earn interest for the residents of the village), is in the best interest of all residents?

Sect (7) (1) Operators must exercise skill, care, and diligence - when exercising the Operators functions.

Q2. If the Operator was unsure, concerned, and wondering what he should do with the surplus to budget, how easy would it have been to ask the Residents' Committee at the time for some direction? Is it the Operator's contention that he has exercised skill, care, and diligence in dealing with this surplus to budget amount of $90,194?

Sect (8) (1) An Operator must act honestly, fairly, and professionally to all parties with negotiations, transactions and any other dealings relating to a resident or prospective residents.

Q3. Is it the Operator contention, that he has acted, fairly and professionally when dealing with the residents and residents committee regarding, the 'surplus to budget' transaction/issue?

Ms. J. S. Smith states, "and therefore the financial management of this transaction, by carrying the surplus forward to the accounts for the next financial year was correct and is concluded."

Q4. From the resident's point of view, the surplus to budget transaction will be concluded when the $90,194 is deposited into the Capital Works Fund as voted by residents. This is certainly a matter that needs to be clarified by Management. As it is the Residents Committee's job to advocate on behalf of residents when dealing with disputes against the Operator/Management, chasing the $90,194 surplus to budget for 2021 should be high on their agenda.