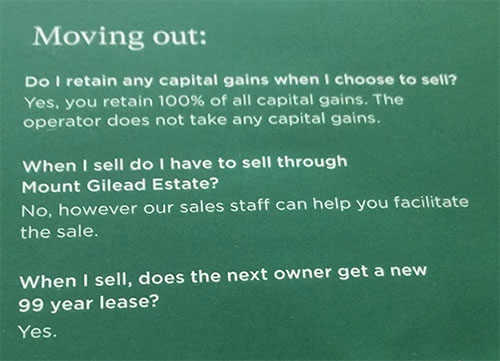

On entry to this village, many residents were informed by the Sales Assistant and confirmed in the glossy brochure provided to prospective buyers that, when leaving the village permanently and selling their villas/apartments, they would retain 100% of any capital gains made during their stay at the village.

However, recent contracts sighted suggest that this assurance may be inaccurate. The formula used by the Operator/Management to calculate the exit fee starts with, and is based on, the 'sales price', rather than the 'purchase price'. Some contracts state 'sales price' or 'purchase price', whichever is greater. Consequently, the operator will use the higher price for calculating the exit fees. This practice certainly appears to contradict the claim that residents keep 100% of capital gains upon exiting the village.

Property values within the village have risen, and residents can reasonably expect to make capital gains when selling their villa/apartment. The exit fee or deferred management fee is a departure fee paid when permanently leaving the village. If the sales staff, brochure, and individual contracts assert that residents keep 100% of any capital gains made during their stay, then surely, the calculation of exit fees should commence with the 'purchase price' instead of the 'sale price'.

Part copy of sales brochure received by many residents:

Ambiguity of resident's contracts: If exit fee calculations begin with the 'sale price' rather than the 'purchase price', it calculates a portion of the capital gains made on the sale of the resident's properties. This conflicts with the statement from the sales assistant, brochure, and individual contracts that residents keep 100% of capital gains on the sale of their apartments or villas.

In the contracts reviewed, the method of calculating the exit fee is shown as an equation that uses either the sale price or purchase price, whichever is greater. This does not resolve the ambiguity within the contract itself. Residents should refer to their individual contracts to ensure the clause, 'residents keep 100% of any capital gains,' is included.

This issue could potentially affect many residents when they leave the village. Clarification should be sought from the Operator/Management. There may be other legitimate charges the Operator is entitled to claim, such as outstanding recurring fees and other incidentals, upon exiting the village.

Below is documentation sourced from Fair Trading, which may provide additional information to residents.

For ‘registered interest holders’

You are a registered interest holder if you are:

- an owner in a strata or community scheme

- an owner of shares in a company title village giving your residence rights

- the holder of a registered long-term lease where you are entitled to at least 50 per cent of the capital gain that may be made by the time you move out.

Your right to live in your unit only ends when:

- the sale of your unit is completed (if you’re the owner), or

- your long-term lease is ended or assigned (if you’re a holder of long-term lease of 50 years or more).

Selling your unit

If you decide to sell your unit, you will need to make the necessary arrangements just like you would to sell a property outside of a village.

- You can set the sale price and appoint a real estate agent to handle the sale.

- If you are using an external agent, operators are required to provide any information and assistance that is necessary to facilitate the sale of the unit.

- Or, you can ask the operator to sell your unit on your behalf – but you don’t have to use the operator if you prefer to use an external agent.

- The person who buys your unit will need to sign a sale of land contract with you as the outgoing resident as well as a village contract with the operator.

- If selling, you must refer anyone who is interested in buying your unit to the operator so they can provide the prospective resident with all necessary information about the village. In some cases, the operator may refuse to enter into an agreement with a purchaser (eg the person is under the minimum age to live there).

Selling costs

If you decide to leave your retirement village there will be costs, fees and charges involved.

- If you are entitled to keep 100 per cent of the capital gain made on your unit, you are responsible for all costs involved in selling the unit.

- Alternatively, if under the contract the operator is entitled to some of the capital gain made on your unit, the operator must also pay some of the selling costs. This amount will be in the same proportion as the capital gain is shared, which in most cases is around 50 per cent. However, if you wish to appoint an agent to sell your unit rather than using the operator or an agent selected by the operator, you alone will have to pay any commission to that agent.

Departure fees

Also known as an ‘exit fee’ or ‘deferred management fee’, a departure fee is the amount you have to pay when you permanently leave the village.

- This fee is paid to the operator when a resident leaves the village (and is usually deducted from the sale price of the unit).

- This payment is often a percentage of the ingoing fee, or the sale price, and is agreed to in the contract upfront.

- This fee can be a significant amount: check your village contract for details!

- Departure fees are a source of income for operators which can be used for purposes not covered by recurrent charges, such as improving or expanding the village services and facilities.

- Departure fees also allow for lower recurrent charges and greater flexibility with entry prices, enabling prospective residents to pay a lower upfront payment by agreeing to an amount being kept by the operator when they leave. This provides more people with access to retirement villages.

Ongoing charges for general services

Ongoing charges for general services (also called ‘recurrent charges’) go towards the upkeep of the village (eg village administration, gardening and maintenance).

Unregistered interest holders

Unregistered interest holders still have access to their 42-day cap. The new 42-day cap provision does not apply to residents who own a lot in strata, or community villages or own shares in company title or trust villages that give them a residence right.

Registered interest holders

- You must continue to pay recurrent charges for general services when you leave your unit. Payment generally continues until a new resident enters into a contract with the operator or starts living in the unit.

- If you share any capital gain made from the sale of your unit with the operator, you only need to pay for these general services for a maximum of 42 days after you leave. After this time, you and the operator share the cost of the recurrent charges in the same proportion as you share the capital gain.

You stop paying these charges as soon as you permanently vacate the premises.

Registered interest holders (who share in the capital gain 50 per cent or more)

New provisions apply to residents whose contract is in the form of a long-term registered lease that entitles them to at least 50 per cent of any capital gain (as detailed below).

42 day cap on recurrent charges from 1 July 2021

Village operators will only be able to charge residents for up to 42 days for general services (gardening, administration, cleaning, etc.) once they have permanently left the property. This will apply to residents on or after 1 July 2021, when their village’s financial year commences.

In relation to the 42 day cap, a person permanently leaves the premises, takes all their possessions and returns the key to the operator, or if the executor or administrator of the person’s estate provides vacant possession of the person’s residential premises to the operator of the retirement village.

Permanent vacation occurs if the former resident dies or moves out of the premises, or the executor or administrator of the person’s estate provides vacant possession of the person’s residential premises to the operator of the retirement village following the person’s death. This definition only applies when section 152 (Recurrent charges in respect of general services: registered interest holders) of the Act is being applied.

The 42-day period can be shortened if:

- the property sells earlier,

- the village contract allows for an earlier date,

- an incoming resident takes up residency, or

- the NSW Civil and Administrative Tribunal (the Tribunal) terminates the contract.

A shortened period would result in general service payments ceasing.

A registered interest holder may choose for whatever reason, to continue to live in the premises until the completion of the sale, and not terminate their contract until this occurs. In this circumstance the resident would continue to pay for general services they receive.

An exemption from the 42-day cap requirements will apply for trust villages where the trust is owned and run for the benefit of residents.

Repairs and renovations

You do not have to make any repairs or renovate your unit before you decide to leave the village. The operator cannot force you to do any work before selling your unit.

Some fixes and improvements may improve the re-sale value of your unit. However, make sure any changes are cost-effective and check first on the permissions you may need to make the changes.